In the field of the Internet, every once in a while there will be a new concept to throw, it’s not, 190 P2P net lending platform automatically shut in the first half. P2P, before “smart investment” the new guy grieve. The financial sector is the Internet and a “death case”?

How fire is the smart investment? Since the beginning of this year, if you don’t know what “smart investment” in the industry I’m sorry greeting people. So, what exactly what the hell is a smart investment? Givenchy iPhone cover

“Smart investment” what the hell is this?

Smart investment (Robo-advisors), also known as robot investment is essentially a pattern of investment advisory services, narrowly understood in a smart stock portfolios recommended trading services, automatic strategy as the representative of the service, according to the investor’s appetite for risk, user portfolio. In a broad sense is considered the investor’s financial situation, to precisely configure their personal wealth, considering a wide range of assets, such as stocks, bonds, insurance and so on.

Employing words is this: the investment community AlphaGo (Alpha Dog). According to the data, through artificial intelligence algorithms, eventually forming the right portfolio, recommending to investors. So here’s the thing, which financial institutions have used the smart investment now? Intelligent investment, now in full swing is pure hype or Internet financial development of the Gospel?

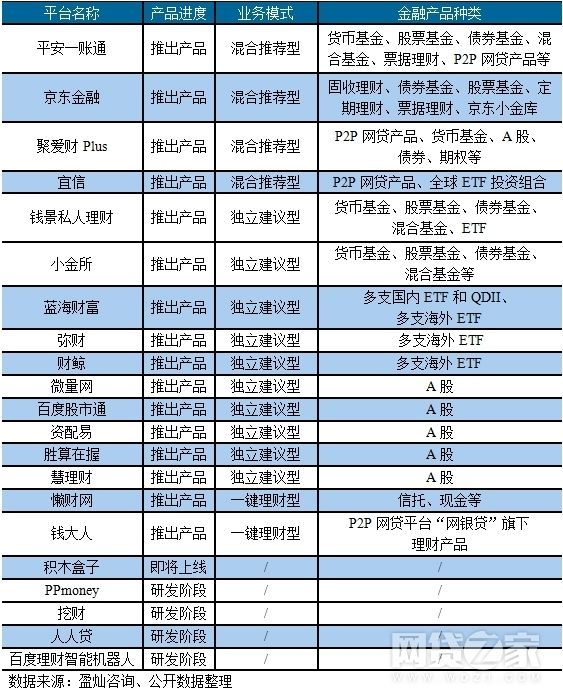

According to incomplete statistics of net loans, now claims to have “smart investment” feature or is developing which financial platform has more than 20, and platform soon followed suit, and joined the army of smart investment. Have ants including the famous Gold suit, safe one account, using letters, digging the fiscal, box of building blocks, the snowball network, there are block boxes, PPmoney, dig money, loans, P2P for all platforms. According to intelligent investment platform business model can be divided into independent advice recommended, mixed and bond financing three types.

Smart investment hype yet?

First is the “intelligence” of the concept. Through intelligent investment package of domestic institutions, can be found, many current Internet banking platform brand of this one-stop public (financial) asset allocation platform, bring different assets to create more of a simple “packaging”, not to mention customer satisfaction personalized, diversified, and internationalization needs.

Fosun brothers Chief Investment Officer Liu Siqi: “smart investment hype, smart investment now is just focusing on improving financial efficiency, such as some roles in bulk orders, currently the world’s leading asset management companies are not totally dependent on the Intelligent analysis system for investment, mainly by analysts, strategists and traders. United States there is no intelligent investment success stories. If AI do investment than humans, develop the AI algorithms that people should go to the stock market with their own developed method, not business. “

June 12, Jiangsu card prison Council released has “Jiangsu card prison Council on Securities Futures business institutions and Internet enterprise cooperation carried out business self-examination rectification of notification” (Xia said “notification”), notification in the stressed, provides Internet voted Gu platform of institutions has obligations on through its platform carried out voted Gu consultant service personnel of qualification for audit; provides voted Gu platform needed made SFC license, without SFC license carried out this class business belongs to illegal business securities business of activities.

So far only 84 domestic securities investment consultation institutions received licensing, but have not yet found a smart investment platform business licence issued by the SFC. In other words, regulators are tightening supervision of securities, and now these smart investment platform is likely to involve violations.

In March this year, after defeating Li Shishi Alpha Dog, it seems all of humanity into a fantasy about AI, AI became known as the outlet, you understand the essence of artificial intelligence began to assume the “omnipotent theory of artificial intelligence”, and happily uses AI to entrepreneurship. As AI Expert Yin God said it, machine learning is just fitted some function parameters, cannot be compared with the human learning. He warns: for people of AlphaGo blood and stop indulging in fantasies such as automatic machines, Skynet. See AI, “neural networks” in real terms, using them to do something useful can be, there’s no need to achieve “human intelligence” hold out much hope.

Stars platform of intelligent investment in other countries?

Speaking of smart investment, as with many Internet concepts, is exotic, Chinese learning and replication, you know. Currently in good intelligence on foreign development investment are mainly three: Wealthfront, and Betterment, and FutureAdvisor. Them leap-forward development depends in part on lower rates in order to get better service at a lower cost. FutureAdvisor rates for direct administration costs cost is slightly higher than for the 0~0.25%;Betterment platform 0.5%;Wealthfront platform Wealthfront, 0.15%~0.35%.

WealthFront founded in 2011, currently manages assets of more than $ 3 billion, is typical of computer algorithms and portfolio of standard investment model for investors management company, is the United States one of the largest intelligence investment company.

Investors want asset management services need to register on the site, investors after the registration is completed, investors will turn to Apex Clearing escrow guarantee financial security. During the hosting period, WealthFront will monitor the dynamic of portfolio and investment plans are regularly updated, so as to control the risks, so that it always falls within the tolerance range for investors.

Betterment was founded in 2010, users log on Betterment just fill in personal information, age, income, retirement, investment, expectation. Platform automatically told investors in a scientific, safe, effective, long-term stock and debt configuration. Users can see the expected benefits, risk factors, terms, investment and other information, can also be in a certain range based on their risk tolerance, adjust the proportion of equity and debt investments.

Betterment of the asset management plan is divided into four main types: high yield investment, stable inflation, plan to spend, pension plan type. Each part of the funds, the length of time to configure different policies.

FutureAdvisor is headquartered in San Francisco, founded by two ex-Microsoft engineer. FutureAdvisor can’t afford or unwilling to direct face to face contact with traditional brokers by investors, and provide recommendations on asset allocation. In recent years, computer operations, combining the customer’s investment goals, income and tax situation, for customers to build professional, rational portfolio to minimize human intervention factor “robot Adviser” in the United States asset management has become more and more popular. Last year, FutureAdvisor valued at about 1.5 per cent to $ 200 million, is the world’s largest fund management company BlackRock (BlackRock) acquisition. Givenchy iPhone case

1808 people voted

Moto 360

MOTO 360 since launch attracted the attention of many, not only because it is a member of Android Wear starting, but also because of its retro and sophisticated appearance design and excellent workmanship. Good design also makes it standout in the ranks of smart watches.

View details of the voting >>